The electric vehicle (EV) market is picking up, and at a rapid pace, with major auto producers making substantial commitments to electrified transport. With the US accounting for just a near-2% of global lithium production, many industry experts say the nation must tap into its lithium resources if we are to rise to the challenge of building a domestic EV supply chain.

As a key provider of lithium processing equipment used in the conversion of spodumene ore to lithium and the recycling of lithium-ion batteries, we are watching the development of this market closely. Here’s a look at the nation’s current standing in lithium, and what could lay ahead.

Current US Lithium Production

The US relies heavily on imports of lithium, with only one mine currently in operation – Albemarle’s Silver Peak brine operation in Nevada.

The lion’s share of global lithium production comes from Australia, Chile, China, and Argentina. But the US is home to sizable lithium deposits, and experts say that we’ll need to take advantage of these resources if we are to build a resilient domestic supply chain and meet the demand for lithium required by the exploding EV market.

The lithium industry is warning of an impending shortage of the metal, imploring new lithium production be brought online as quickly as possible, and not just in the US; the global project pipeline isn’t anywhere near enough to keep up with the boom in demand. Rio Tinto, who recently dove into the lithium industry with their Jadar project in Serbia, recently told investors that 60 Jadar projects couldn’t fill the gap in supply, according to Mining.com.

Bolstering Lithium Production in the US

While automakers and battery producers are making investments in US EV production, those facilities depend on a reliable and affordable supply of lithium. And the nation’s stock of natural resources means little if there is no policy in place to support development in the industry. This, paired with the impending shortage and a commitment by the Biden administration to reach 100% clean energy by 2035, has led to a flurry of activity around bolstering a domestic EV supply chain.

Early in 2021, President Biden met with Canada’s Prime Minister, Justin Trudeau, to discuss collaboration on various issues – a North American EV supply chain being one of them; Canada is also home to a fair share of lithium resources, making a joint effort on a North American supply chain between the allied nations a no-brainer.

In June, the US Federal Consortium for Advanced Batteries laid out their National Blueprint for Lithium Batteries to provide guidance to investors in a domestic lithium battery supply chain.

According the blueprint:

The worldwide lithium-battery market is expected to grow by a factor of 5 to 10 in the next decade. The U.S. industrial base must be positioned to respond to this vast increase in market demand that otherwise will likely benefit well-resourced and supported competitors in Asia and Europe.

The blueprint outlines several factors crucial to developing a competitive domestic battery industry, securing a safe and reliable domestic supply chain of raw materials among them.

“Without action, the U.S. risks long-term dependence on foreign sources of batteries and critical materials,” the blueprint states.

The infrastructure plan is also slated to provide significant support for a domestic supply chain. Efforts have already proven to promote a healthy environment for creating a domestic market, a fact highlighted in BloombergNEF’s release of their second “Global lithium-ion battery supply chain ranking.”

In 2020, the firm ranked the US in sixth place (not surprisingly, China was in first), but this year, the US has moved up four spots to second place, just behind China, though European countries were ranked separately, skewing the region’s standing.

The analysis takes a number of factors into account to rank countries, including not just available raw material resources, but also considerations in manufacturing, environment, regulation and infrastructure, as well as demand.

Available Lithium Resources

According to the US Geological Survey (USGS), the United States is home to 7.9 million tons of lithium resources, accounting for roughly 10% of global resources. The US hosts all types of lithium resources, with the majority falling under the volcano-sedimentary type. Other types include

- Continental Brine

- Geothermal and oilfield brine

- Pegmatite and Granite

According to the British Geological Survey, US lithium resources can be broken down as follows (see map below):

- McDermitt (volcanic-sedimentary)

- Kings Valley (volcanic-sedimentary)

- Bonnie Claire (volcanic-sedimentary)

- Boron (volcanic-sedimentary)

- Clayton North (volcanic-sedimentary)

- Silver Peak (continental brine)

- Salton Sea (geothermal and oilfield brine)

- Magnolia (geothermal and oilfield brine)

- Kings Mountain (pegmatite & granite)

British Geological Survey map of global lithium mines, deposits, and occurrences (click to view larger). Source: Shaw, R.A. (2021) Global lithium (Li) mines, deposits and occurrences (June 2021). British Geological Survey.

A new spodumene lithium source – the Plumbago North Pegmatite – was also recently discovered in Maine and is said to be the richest known deposit of hard rock lithium on the planet. The deposit has an estimated worth of $1.5 billion at current market prices, but Maine has historically discouraged mining of smaller lithium resources in the state.

Numerous mines around these resources are working toward production, including Rhyolite Ridge, Thacker Pass, Clayton Valley, and many others, along with efforts to commercialize the lithium lying under California’s Salton Sea. And while various projects are in the works, many in the mining industry are worried that some legislative efforts, such as the proposed royalties on hard rock mining operations, could actually hamper efforts.

Lithium Processing Infrastructure Needed

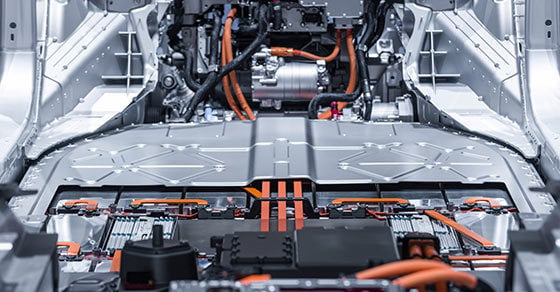

Gaining access to these resources is not the only challenge to a robust domestic EV industry; the US also needs to build out the rest of the battery supply chain as well, from refining to recycling end-of-life lithium batteries.

Adequate recycling infrastructure will be especially critical in creating a sustainable lithium supply chain, as it will provide a circular approach to managing the flood of end-of-life batteries that will inevitably hit the market. In May, Senator Angus King. Jr. of Maine introduced a bill aimed at funding research around recovering and reusing the valuable components contained in spent lithium-ion batteries.

Conclusion

The growing push to develop a domestic EV supply chain that can compete on the global stage relies heavily on the US’s ability to take advantage of the lithium resources hosted beneath the nation’s soils. Not only that, but the infrastructure required to process those resources is also essential.

FEECO serves as a valuable resource to the lithium industry, with testing services and custom rotary kilns for processing spodumene and developing lithium-ion battery recycling operations to maximize recovery. For more information on our capabilities, contact us today!