EQUIPMENT

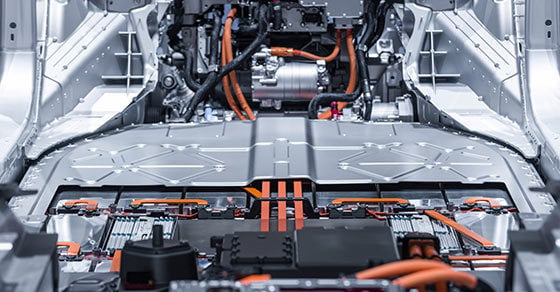

The production of lithium compounds is becoming increasingly important in producing lithium-ion batteries for use in consumer electronics, electric vehicles, and other energy storage applications.

While we do not provide equipment for processing lithium brines, FEECO is a leader in advanced thermal processing and agglomeration equipment and supporting services for the processing of lithium-bearing ores, most notably spodumene.

MATERIAL PROCESSING

Thermal Processing

With unmatched expertise in thermal processing, FEECO can supply rotary kilns for roasting, indirect kilns for use in the sulfonation process, as well as dryers for lithium concentrate, and rotary coolers for cooling material exiting the sulfonation process.

Agglomeration

FEECO is the world’s leading provider of custom non-pressure (tumble growth/agitation) agglomeration equipment and systems. We offer pin mixers, pug mills (paddle mixers), disc pelletizers, and rotary drums for lithium mixing, conditioning, and pelletizing.

BULK MATERIAL HANDLING

FEECO provides an array of custom bulk material handling equipment and systems for use in lithium handling applications. This includes bucket elevators, belt conveyors, reversing shuttle conveyors, steep incline conveyors, and more.

FEECO bulk handling equipment can also be equipped with a variety of equipment to increase the flexibility of the system, including belt trippers and plows, as well as belt feeders.

PLANT AND PILOT SCALE PROCESS TESTING AND DESIGN

With challenging characteristics and wide variability, testing is often a critical component in the success of a lithium processing operation. The FEECO Innovation Center is a unique testing facility where we can test your material at both batch and pilot scale in order to work out process variables and design commercial-scale units, as well as scale up the process.

The FEECO Innovation Center is well-equipped to suit a wide range of testing needs, including pelletizing, drying, and roll compaction. We can test on a single piece of equipment, or a continuous process loop.

We offer comprehensive testing services in four categories:

Feasibility/Proof of Concept: An initial, non-witnessed batch testing phase in which the possibility of creating a product is explored.

Proof of Product: A more in-depth batch testing phase in which more time is spent determining whether a product can be made to desired specifications.

Proof of Process: A continuous testing phase that aims to establish the equipment setup and parameters required for continuous production of your specific material.

Process/Product Optimization: An in-depth study to optimize your specific material’s characteristics and/or production parameters in an industrial setting.

Learn more about the Innovation Center >>

PARTS & SERVICE

FEECO provides a comprehensive offering of parts and service to keep your equipment running its best for years to come. This includes a variety of field services, process and equipment audits, spare parts, and more.

RESOURCES

LITHIUM ARTICLES

A Look at US Lithium Production

The electric vehicle (EV) market is picking up, and at a rapid pace, with major auto producers making substantial commitments to …

Growing Competition in the Electric Vehicle Market Increases Demand for Lithium

As a key supplier of lithium processing equipment, we’ve been monitoring the EV market closely. And if there was any uncertainty …