In a significant move to enhance national security and economic resilience, the Trump administration has initiated a comprehensive strategy to bolster domestic production of critical minerals. This initiative not only aims to reduce reliance on foreign sources but also presents substantial growth prospects for mining and mineral processing equipment manufacturers.

Executive Order to Expedite Mineral Production

On March 20, 2025, President Donald J. Trump signed the Executive Order titled “Immediate Measures to Increase American Mineral Production.” This directive mandates federal agencies to prioritize and expedite the permitting process for mineral production projects, aiming to streamline operations and reduce bureaucratic delays. The order also emphasizes the importance of utilizing federal lands for mineral development and encourages public-private partnerships to advance these goals.

First Wave of Fast-Tracked Projects

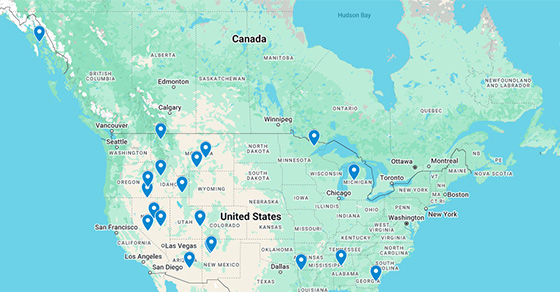

Following the executive order, the Federal Permitting Improvement Steering Council announced an initial list of strategically significant critical mineral projects selected for expedited permitting. These projects, along with the second wave of projects, are outlined here and plotted on the map below.

Resolution Copper Project (Arizona)

The Resolution Copper Project, near Superior, Arizona, is a joint venture between Rio Tinto and BHP that aims to supply more than 25% of U.S. copper demand. Copper is essential to electric vehicles, grid infrastructure, and electronics. The project is projected to contribute $61 billion to Arizona’s economy and generate thousands of jobs.

Stibnite Gold Project (Idaho)

The Stibnite Gold Project, located in Idaho’s Valley County, is set to become the nation’s only domestic source of antimony, a critical mineral used in flame retardants, batteries, and defense applications. The project is owned by Perpetua Resources.

Blue Creek Project (Alabama)

Operated by Warrior Met Coal, the Blue Creek expansion project produces high-quality metallurgical coal. The expansion will increase nameplate capacity by 25%, supporting both domestic steel industries and export markets.

McDermitt Exploration Project (Nevada)

The McDermitt Exploration project is a host to the potentially largest source of lithium clays in the world. Lithium is essential for EV batteries and energy storage technologies. Owned by US Critical Metals (USCM), the project is located near the Thacker Pass project and sits within the lithium-rich McDermitt Caldera Margin.

South West Arkansas Project (Arkansas)

The South West Arkansas project, a joint venture between Standard Lithium Ltd. and Equinor, aims to unlock large-scale lithium extraction using innovative DLE (direct lithium extraction) technology. It received a $225 million DOE grant in early 2025, signaling federal confidence in its role in securing lithium supplies.

Caldwell Canyon Mine Project (Idaho)

Owned by Bayer, The Caldwell Canyon Mine project is a proposed phosphate mine that will support agricultural fertilizer production, addressing long-term food security and reducing reliance on imported phosphorus products.

Libby Exploration Project (Montana)

Owned by Hecla Mining Company, the Libby Exploration project holds an estimated 500 million ounces of silver and four billion pounds of copper, both of which are key to renewable energy systems, electronics, and medical technologies.

Lisbon Valley Copper Project (Utah)

Located southeast of Moab, the Lisbon Valley Copper project will support the domestic supply of copper. Operated by Lisbon Valley Mining Company, the mine employs a closed-loop recovery process, reusing or recycling all consumable materials.

Silver Peak Lithium Mine (Nevada)

Currently the only operational lithium mine in the U.S., Albemarle’s Silver Peak mine is undergoing an expansion that will double production. It plays a central role in meeting rising demand for lithium in electric vehicles and grid storage systems.

Michigan Potash Project (Michigan)

The Michigan Potash project, owned by Michigan Potash & Salt Company (MPSC), aims to reduce U.S. dependence on imported potash, which is pivotal to crop production. Located in Michigan’s Osceola County, the deposit is the only known domestic source of potash and could supply around 10% of the nation’s demand.

Second Wave of Fast-Tracked Projects

Not long after the first wave of projects was announced, the White House released an additional list (included in the map above):

NorthMet (Minnesota)

Owned by NewRange, a joint venture between Glencore and Teck Resources, the NorthMet project is located in the Duluth Complex in northeastern Minnesota. Already situated amongst well-developed mining infrastructure, the open pit mine is expected to produce copper and nickel-copper concentrates, both of which are critical to energy independence.

La Jara Mesa (New Mexico)

Laramide Resources Ltd.’s La Jara Mesa is a uranium project located in New Mexico. Domestic uranium production is vital to establishing the nuclear energy needed to meet rising demand for electricity.

Roca Honda (New Mexico)

Roca Honda is an advanced-stage uranium mine that also calls New Mexico home. Owned by Energy Fuels, the mine is one of the largest and highest-grade uranium projects in the nation.

Greens Creek (Alaska)

Greens Creek is a surface exploration project being developed by Hecla Mining Company. Located on Admiralty Island in Alaska, the project aims to develop gold, silver, lead, and zinc resources. Hecla’s Greens Creek Mine is already one of the largest and lowest-cost primary silver mines globally.

Stillwater West (Montana)

Owned by Stillwater Critical Minerals, Stillwater West is located in one of the world’s largest and highest-grade PGE-Ni-Cu regions in Montana’s Stillwater District. Stillwater Critical Minerals is developing the project into a world-class, low-carbon source of various critical minerals, including nickel, copper, cobalt, platinum, palladium, and rhodium.

Polaris (Nevada)

The Polaris project is an expansion of existing gold exploration work. The site was formerly owned by Klondex Mines, which was acquired by Hecla Mining in 2018. Details on the project are currently limited.

Beckys Mine Modification

Operated by American Colloid Company (ACC), a subsidiary of Minerals Technologies Inc., Beckys Mine consists of private and federal lands near Warren, Montana. The site is a former bentonite mine reclaimed in the 1970s, prior to the Surface Mining Control and Reclamation Act and Federal Land Policy and Management Act. ACC will extract remaining bentonite resources and improve land reclamation.

3PL Railroad Valley Exploration (Nevada)

3 Proton Lithium (3PL) is exploring the Railroad Valley’s Super-Bring Complex, North America’s largest identified lithium and boron deposit. Beyond lithium’s importance in energy and batteries, boron is essential in various energy applications and electronics.

Grassy Mountain Mine (Oregon)

Paramount Gold’s Grassy Mountain Mine is located in Malheur County, Oregon. Paramount aims to develop the high-grade underground gold mine into Oregon’s first modern gold mine.

Amelia A&B

Owned by The Chemours Company, the Amelia A&B Mine located in Georgia will use minimally invasive mining to extract several materials used in the manufacturing of titanium dioxide and other materials. This includes ilmenite, staurolite, and zircon.

These initiatives can now be followed on the Federal Permitting Dashboard, enhancing transparency and accountability in the permitting process.

Implications for Equipment Manufacturers

The acceleration of domestic mineral production is poised to generate increased demand for mining and mineral processing equipment. Original equipment manufacturers (OEMs) are well-positioned to support the surge in development and benefit in several key areas:

- Increased Orders: New and expanding operations will require rotary dryers, kilns, conveyors, agglomeration drums, and a range of other processing equipment.

- Technological Innovation: The demand for efficiency will spur R&D and the adoption of advanced designs.

- Long-Term Contracts: Stable, long-term projects offer opportunities for equipment supply partnerships and ongoing parts and service agreements.

Companies specializing in material handling, thermal processing, and agglomeration equipment are particularly well-positioned to capitalize on this growth. These systems are foundational to nearly all mineral processing operations, from lithium extraction to phosphate and potash granulation.

The Need for Testing

Batch- and pilot-scale testing capabilities, such as those available at the FEECO Innovation Center, will play a critical role in securing a domestic supply of critical minerals. As mining companies look to engineer new processes and optimize operational efficiencies, facilities like this offer the opportunity to reduce risk on the path to commercial scale-up of key production processes.

National Security and Economic Benefits

By reducing dependence on foreign sources for critical minerals, the U.S. aims to strengthen its supply chains, particularly for industries vital to national security, such as defense, electronics, and renewable energy. The administration’s actions are expected to:

- Enhance Economic Resilience: Domestic production mitigates risks associated with global supply disruptions.

- Create Jobs: The mining sector’s expansion will lead to employment opportunities across various regions.

- Promote Technological Advancement: Investments in mineral processing will spur innovation in related technologies.

Conclusion

The Trump administration’s proactive measures to expedite critical mineral production signify a pivotal shift towards self-reliance and economic fortification. For original equipment manufacturers and service providers, this presents a timely opportunity to align with national objectives and contribute to a robust domestic supply chain.

In business since 1951, FEECO is the mining industry’s preferred provider for robust agglomeration, thermal processing, and material handling equipment, ranging from agglomeration drums to rotary dryers and kilns. With batch- and pilot-scale testing available, plus comprehensive parts and service support, we offer end-to-end solutions that help producers optimize performance, minimize downtime, and scale processes with confidence. To learn how we can support your mineral processing initiative, contact us today!