The frac sand industry continues to experience rising demand as drillers pump more of the proppant sand down wells than ever before. Where that sand is coming from, however, is changing; hydraulic frackers are looking to localized supplies of frac sand in an effort to reduce transportation costs and maximize the ROI on wells, causing a major shift in the frac sand supply system.

The Frac Sand Supply Shift

During the previous oil boom, drillers brought in premium frac sand from the St. Peter Sandstone formation in the Midwestern states. St. Peter Sandstone, particularly under Wisconsin, is home to the world’s highest quality source of frac sand. Often referred to as Northern White, this quartz sand has been sought out for its superior hardness, roundness, uniformity, and other qualities that make it ideal for use as a proppant in the hydraulic fracturing process.

This surge in demand saw a scramble for mining sand in the Badger state and surrounding areas, with sand mines and processing plants cropping up nearly overnight.

During the industry downturn, however, frackers opted for local supplies of lower quality sand to avoid the costly expense of shipping in sand from the Midwest. Despite their lower quality, these local sources of frac sand proved to offer a sufficient proppant in most cases.

As oil prices began to bounce back in 2016, drillers stuck with the lower-cost alternative; by choosing more localized sources of frac sand, they could reduce the cost of operation, ultimately improving the economics around the lower margins of the recovering prices. Estimates hover around 40-50% in cost savings by opting for local sand sources.

As a result, frac sand supply has become less about quality and more about locale in relation to the drilling sites. It’s important to note that quality is still an important factor when it comes to frac sand; not just any sand is suitable for use in the hydraulic fracturing process and sand must meet a variety of quality standards to qualify for use as a proppant.

While Midwestern sand is still in demand for deeper well bores and is largely continuing to supply the industry, many experts anticipate demand for Northern White to dwindle when frac sand supply infrastructure catches up closer to rig sites.

In their recent study, Coras Oilfield Research projects that production of Northern White sand is likely to level off at 45 MM tons per year, while production from West Texas has the potential to grow more than 60% by 2019.

Local Frac Sand

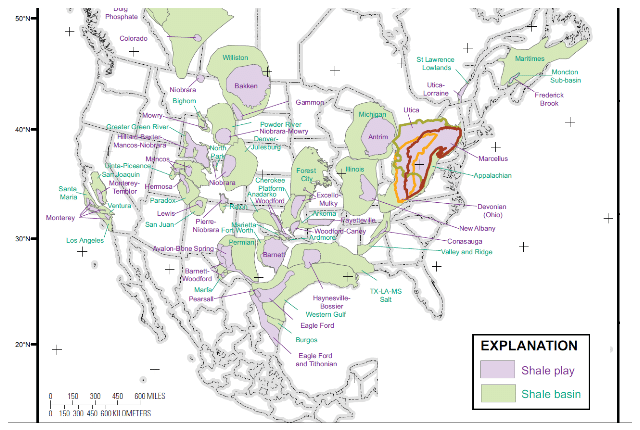

This trend of using local sand sources, referred to as “in-basin” sand, is creating a flurry of activity around oil basins. Two shale basins in particular – the Permian Basin and the SCOOP/STACK basin – are seeing the most drilling, and with nearby sources of cheaper sand, it’s not surprising that drillers are looking to take advantage of the frac sand sources closer to home.

Map of shale basins and plays (USGS)

The Permian Basin

Although the industry is well established for oil and gas mining, the Permian Basin currently lacks much of the infrastructure needed to efficiently mine, process, and deliver frac sand to well sites, even despite the close proximity. Frac sand mines, processing plants where sand is washed and dried, and transportation infrastructure are all a necessity in making local sand sources economically viable. This has been a challenge in supplying the insatiable demand for frac sand in the Southern US, and why many drillers are still relying on Midwestern sand supplies. But experts predict this likely won’t last for long.

Locations all around the Permian are experiencing a surge in infrastructure growth to support frac sand supply to the South Central region. At the end of December 2017, Odessa American reported that research group Infill Thinking was tracking the announcement of 23 frac sand sites.

Select Sands, a Vancouver, British Columbia-based frac sand supplier announced at the end of 2017 that they intend to serve the Permian and Eagle Ford basins by moving sand down the Mississippi River on a barge from their Arkansas facility.

Sand local to the Permian basin, referred to as “Brown” or “Brady” sand, is primarily sourced from the Hickory Sandstone Member of the Upper Cambrian Riley Formation of the Moore Hollow Group.

The STACK/SCOOP Basin

Likewise in the South Central Oklahoma Oil Province, or “SCOOP/STACK” basin, frac sand sites are also beginning to dot the landscape, as drillers look for supplies of in-basin sand.

South central Oklahoma is home to the Middle Ordovician Oil Creek Formation of the Simpson Group, commonly referred to as the Oil Creek formation.

Currently, US Silica runs a sand mining and processing operation in Mill Creek, where they source sand for a variety of applications, hydraulic fracturing included. Preferred Sands, another leading supplier, recently began construction on its Oakwood, Oklahoma frac sand facility.

In a recent press release, Preferred Sands founder and CEO Michael O’Neill states: “As a leader in the frac sand business, we will continue to pioneer our national in-basin sand strategy in the SCOOP and STACK plays of Oklahoma. We take pride in our superior products and customer service and are excited to partner with some of the largest oil and gas companies in the area as we continue our commitment to lowering costs and increasing production.” The company recently sold off their Midwest frac sand facilities and built plants in Texas to provide an in-basin source of frac sand.

Industry source Infill Thinking says the development in this region is similar to the “land-grab” that occurred in the Permian and Eagle Ford basins recently.

In-Basin Sand: Not Just in the South

The in-basin sand trend is not isolated to the South Central US; the shift is occurring in Canada as well, where frac sand mines are also being developed to serve the region.

Regarding the in-basin sand trend, Thomas Jacob, analyst at Rystad, told the Lacrosse Tribune, “If this becomes a phenomenon and everyone starts investing in these local supply centers, then northern white sand is at risk.”

Northern White sand is likely to remain an important resource for the industry, but it will now be far from the only resource.

Conclusion

While the frac sand industry is booming, a shift in sand supply is occurring; hydraulic fracturing drillers are relying on in-basin sand supplies, despite their lower quality, as a way to significantly reduce operational costs.

This has started a flurry of activity around developing frac sand mines, processing plants, and supporting infrastructure in places like the Permian and SCOOP/STACK basins, leaving many anticipating a decline in Northern White sand sourced from the Midwest.

FEECO provides the industry’s most reliable and efficient rotary dryers for use in frac sand drying plants. Our custom rotary dryers are engineered around the unique characteristics of frac sand in mind in order to provide a durable, reliable, and long-lasting drying solution in a demanding setting.

For more information on our frac sand dryers, contact us today!